HIGHLIGHTS

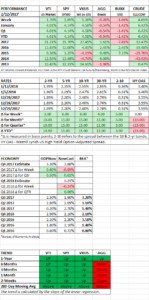

- Stocks were up by 1.65% for the week and 4.14% for the year.

- Interest rates increased across the board, the 2-year is at 1.99%, yielding more than equities.

- Market bulls are counting on big earnings increases and a stable p/e ratio.

- GDP estimates are above 3% for Q4 and Q1, indicating strong growth.

MARKET RECAP

What many are describing as a “melt-up” continued on Wall Street, as US equities increased by 1.65%. The market is now up 4.14% after nine trading days and has advanced eight out of nine times. The one loss for the year was on Wednesday when stocks dropped a mighty 0.16%. International stocks were up 1.30% for the week and are up 4.58% for the year. The dollar declined by 1.06% and crude oil increased by 4.65%.

We had described a few times last year the market’s stairstep pattern of increases. Basically, stocks would consolidate and then advance, and repeat the pattern. Since mid-November, the stairsteps have been replaced by an accelerating angle higher.

Meanwhile, interest rates are increasing across the board. The two-year treasury closed the week yielding 1.99%, more than the yield on US stocks (about 1.80%). It was just recently that stocks were yielding more than the 10-year, now they yield less than the two-year.

Stock market bulls are banking on big earnings increases and a stable price/earnings (p/e) ratio. The earnings estimate for 2017 for the S&P 500 is $131.48 per Thomson Reuters I/B/E/S. For 2018, helped by tax cuts, earnings are estimated to come in at $150.15, an increase of 14.2%. 2019 estimates are for $166, an increase of 10.6%. These are optimistic numbers. The problem is that if interest rates continue to increase, there will be a gravitational pull for the p/e ratio to decline, which will offset to some degree the higher earnings. And then, of course, the higher earnings have to actually come through.

ECONOMY

The GDPNow estimate for 2017 Q4 growth increased by 1/2% on a strong retail sales report. The estimate is now at 3.3%, up from 2.8%. The NY Fed Nowcast has growth estimated at 3.88% for Q4 and 3.21% for Q1.

The Consumer Price Index rose by 0.1% in December. Core CPI was up 0.3%, the most since last January. Most of that increase was due to an increase in the cost of shelter. Year over year the index is up 2.1%.

SCOREBOARD